Why Choose Motorkitty?

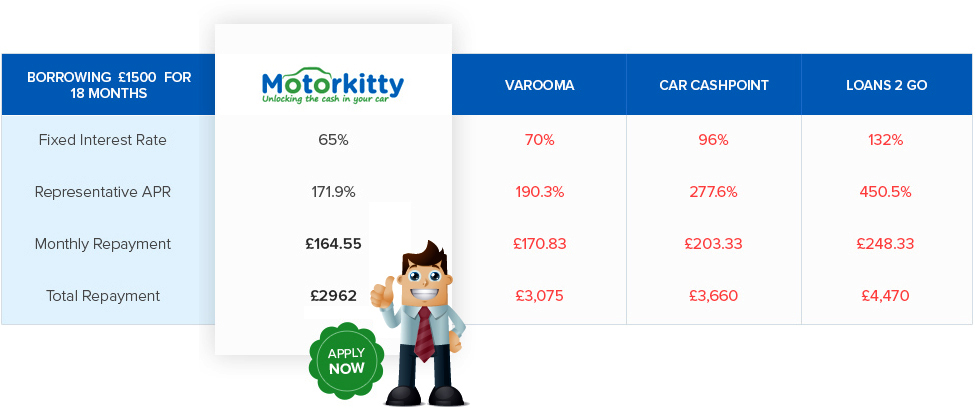

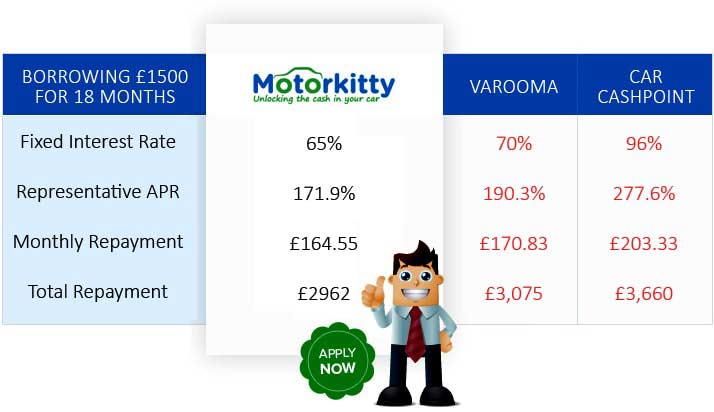

- Can't be beaten on price or loan terms

- Provider of the Lowest Rates in the UK

- Bad credit accepted

- 1 minute application

- Switch to us & save money

Motorkitty Reviews

-

A* Service!

One call, cash same day, cheapest lender in the market. Great!

Allyson - 26th August -

Good company to use

Was concerned about using these companies, but I have to say the service was excellent and after lots of looking around, these guys were the cheapest.

Justin - 24th August -

Great - Thank you!

Fast and reliable, great customer service!

Jeanine - 22nd August